Boost Your Financial Knowledge

If you’re looking for a place to start, we’ve got you covered. Whether it's questions about homebuying, budgeting, or managing your credit we are ready to lend a hand.

Understanding your finances can seem like a daunting task, but with the proper stepping stones you can become a financial wiz! Look over our resources and start building confidence in your financial future.

-

Budgeting and Saving

Budgeting and saving can be easier than you think. We show you how to plan for your financial goals in a way that works for you.Start Planning -

Learning Center

Expand your financial smarts with our free online courses. Knowledge is power after all, start learning today.Explore Courses -

Boost Credit Scores

Understand how your credit score is calculated and explore ways to raise it over time.See Tips to Improve

-

Savings Accounts

Build your savings with competitive rates and great returns. Check out our certificate and money market accounts.Compare Options -

Keys to Homebuying

Ready to buy a new home? Learn the step-by-step homebuying process from our experienced loan officers.Get Homebuying Guidance

Time for an Annual Insurance Review

Time for an Annual Insurance Review

Are you overpaying for insurance? A quick end-of-year review of your health, homeowner's, auto and life coverage can help you find out. It's the best way to ensure everything is up-to-date and discover ways to save money.

Here’s how to conduct a quick review that can lead to real savings:

- Pull all current policies (homeowner’s or renter’s, auto, health and life).

- List changes from the past year, such as new drivers, reduced driving, renovations, family updates, etc.

- Check current coverage against your actual needs. Are your limits too high? Too low?

- Call your insurer to ask about available discounts or updated rates.

- Get comparison quotes from at least two other providers, even if they’re just for reference.

- Weigh your options based on price, coverage and service – not just the cheapest deal.

Learn more about how to get the best value from your policies and find out when to switch or stick with your current provider.

Reduce Your Student Debt

It’s never a bad time to look over your student loans. Whether you’re just starting to pay off your debt, or you want to speed up the process to get out of debt faster, we have tips to help!

Quick Payment Tips

- Extra Payments on Principal: Make additional payments solely on your principal balance. This can drastically reduce the time it takes to pay off a loan if done consistently.

- Biweekly Payments: Pay half your bill every two weeks. You’ll end up making an extra payment each year, taking time off your repayment.

- Refinance: If you have a steady job, good credit and the loan in question is a private loan, you can refinance to reduce interest and duration. When you reduce the term length of a loan this usually comes with a higher monthly payment. Making less payments at a higher amount will reduce the total number of payments needed to pay it off.

- Interest Only Payments: If you’re still in school you can pay down the interest that is accruing while in forbearance. Forbearance means you’re temporarily postponing your loan payments. It’s a temporary pause, not a forgiveness of debt. This will prevent your interest from capitalizing, and you’ll have less to pay back when you enter the payment period.

- Grace Period or Forbearance: If you have fallen on hard times or have trouble finding a job after school, reach out to your loan provider for assistance. It won’t hurt to ask for an extended grace period or forbearance before having to make payments on your loan.

Explore Different Angles

Your current repayment plan might not be the best fit anymore. The one you originally set up or the plan that was automatically put in place, after starting repayment may not work for your situation. For most student loans, you can reach out to your loan provider to discuss other options if needed.

This may not help you repay your loan faster, but the last thing you want is to be in a situation where you can’t afford your monthly payments. Sometimes making a temporary change to get back on track is the best course of action. Once you’re comfortable with a higher payment again, switch back to your original plan and crush your payment goals!

Balancing and Saving

Time to get in a budgeting and saving mindset. Getting into this habit and learning how to save is a great step when repaying your debts. It will also set you up for long-term success! Figure out what you owe, and make your student loan repayment part of your monthly budget. Remember, building a savings account while paying off loans is just as important as budgeting.

We have plenty of savings tips and budgeting systems on this page to help you out. Check them out so you can build confidence in your savings while also paying off debt.

Your Top Auto Questions Answered

Time to boost your car buying knowledge! The car buying process can have a lot of moving parts, but here’s some good news: We sat down with our local expert to get answers on the most important topics.

Check out the interview and get an inside scoop on the following subjects:

- What is a car loan?

- Buying vs. leasing

- When to start looking

- Choosing a loan term

- Down payment impact

Boost Your Home’s Value

Make your home worth more by making it work for you! Looking for ways to boost your curb appeal? Whether you are renovating your kitchen, replacing your siding or building a new deck, a HELOC is the right choice for all your projects. Check out our recent article on everything you need to know about adding value to your home!

Learn about:

- Project budgeting tips

- Funding strategies

- Aesthetic upgrades that pay off

- High-impact renovation ideas

Saving for Vacation

Vacation memories shouldn’t come with financial stress. Here’s how to make smart preparations, stay on budget and get the most value from your getaway.

Plan, plan and plan some more! One of the best ways to avoid unnecessary expenses on vacation is to plan ahead. Putting in the effort to research the specifics of your vacation spot can help get the most out of your days without having to worry about last-minute expenses or unforeseen situations. Address the following before booking your next trip.

- Best time to visit

- Local weather

- Travel insurance

- Transportation options

- Local customs

While we encourage you to take a load off once you arrive at your destination, keep a budget in the back of your mind. If you can, try to stick to a daily budget so you don’t overspend or impulse buy. The last thing you want to do is to use up all the money you saved in one day.

What’s better, packing the car for a family road trip or soaring through the sky to your destination? Whatever you choose, make sure you consider the possible costs. Buying a plane ticket may look like a big expense, but a 20-hour drive may end up costing more. When you add up the cost of gas, snacks, tolls and a possible overnight stay, you may end up spending more on the road than on a flight ticket. Try a few of these road trip tips to save you money:

- Calculate mileage to manage the cost of gas

- Prep snacks and meals before leaving

- Swap drivers to skip hotels

- Put money on an E-pass or pay tolls online to avoid toll lines

- Do some car maintenance before leaving

The two biggest costs when it comes to vacations are usually flights and hotel stays. Knowing the best time to book a flight or hotels is just as important as shopping for the best price. There are plenty of sites, apps or articles out there that can help you save money on flights or hotel prices. To get you started, here are a few common tips to help you save in the long run.

Hotel Saving Tips

- Book with a hotel directly instead of a discount site

- Steer clear of peak days like Fridays for check-in or Sundays for check out

- Booking stays on Monday and Tuesday are often cheaper

- Booking the day before, for short trips often has reduced prices

- Use the rewards points you get from a Landmark Rewards Credit Card

Flight Saving Tips

- Departing Monday, Tuesday or Wednesdays are usually cheaper than weekends

- Flights with layovers can be as much as 20% cheaper

- Consider multiple airports when searching

- Use a price tracker

Manage Your Money From Anywhere

Your banking experience should feel safe and convenient. Digital Banking gives you secure, around the clock access to your money. Our online platform is loaded with convenient budgeting features, a personalized interface, expense tracking and enhanced safety features for all your banking needs.

Start managing your money anytime, anywhere with Digital Banking or download our mobile app, for 24/7 banking in the palm of your hand.

30 Days to Financial Wellness Calendar

Keeping your finances top of mind is much easier with a daily tracker! Get a free copy of our 30-day savings and wellness calendar. Plus, we’ve recently updated our calendar with tips and tricks directly from our members!

Top Ways to Start Saving

Want to see your favorite band or go on vacation without worrying about your bank account? Take advantage of these three savings tips to reach your goals or eliminate debt faster. Let us help you raise to the challenge of adding money to your savings with consistency. While there are plenty of simple ways to save daily, these three steps can provide that initial boost to your new savings mindset.

Set up accounts for specific saving buckets like rent, fun or a new car. Creating a separate account for a specific savings goal helps keep a constant eye on your progress. Learning how to move your money around with separate accounts creates a positive financial habit and can keep your goal top of mind.

Use our budgeting systems to help eliminate credit debt or student loans. Eliminating debt is one of the best ways to increase the amount you save every month. The best part is, there are plenty of unique budgeting strategies available for you to try out! Check out some of the suggested budgeting strategies below, and find the one that works the best for you.

Schedule recurring transfers from your checking account to your savings account each month. When you automate your cashflow, you can pull money from your paychecks without having to even think about it. Create an “out of sight out of mind” style of saving for your goals.

Simple Ways to Save Every Day

It’s time to shift your mindset from spending to saving! You don’t always need a specific account type to provide a significant boost to your savings. You can save a lot more than you think by making simple adjustments to your everyday life. To start, try creating a basic savings account in Digital Banking specifically for you vacation or emergency fund goal. Next, use tips like these to save you money on a daily, weekly or monthly basis.

-

Start Setting Goals

Keep things simple, smart and effective. Try making daily or long-term savings goals to keep your mind on a savings track.

-

Make Coffee at Home

Buying coffee is a luxury that we all fall into. Did you know that you can save hundreds a year by making coffee at home? Try reducing the amount of coffee you buy in the morning, and the amount you go out to lunch or dinner.

-

Learn to Say No

Practice standing your ground to stop unnecessary spending habits. Normalize living within your means and establish “wants” versus “needs.”

-

Be a Budget Hero

Research, find a plan that works for you and stay on track with a budget. Without a budget, most of your saved funds could end up being accidentally spent.

-

Stop Subscription Creep

We often sign up for free trials and forget to cancel before the charges happen. Make sure you’re only paying for subscriptions that you use.

Using Credit Cards Wisely

Using Credit Cards Wisely

A credit card is a great tool to have for your financial needs. They can be used to build your credit score, for travel benefits and more. Just be cautious if you are using one for all your expenses.

It’s easy to create a pile of debt with credit card purchases, interest and fees. Learning to use your credit card responsibly is an important skill so you don’t end up with debt you can’t afford to pay back. Lookout for the following pitfalls when using your credit cards.

Paying on Time

If you use your card for everyday spending, you can use features like auto pay to make sure you never miss a payment. When you pay your balance in full each month you can maximize the benefits and protections that come along with your credit card. Keep in mind, missing payments can negatively affect your credit score.

Know Your Limit

Live within your means and purchase what you can afford. Be smart about your spending habits, and never spend up to your limit. Just because you have access to more money, does not mean you should use all of it. If you have trouble overspending, you can add spending limits using our card management tool in Digital Banking.

Keep it Under 30%

Experts suggest that you should use less than 30% of your credit. Going over that limit can incur higher fees and quickly prevent you from paying down debts.

Monitor For Fraud

Set up alerts to monitor fraud. Always keep an eye on your transactions for phony purchases. If you notice charges like these, notify your card company and put a hold on your account. Landmark members can easily monitor transactions like these or put their card on hold by using our mobile app.

Fees and Interest

Understand fees and how interest will be charged to your card. Annual fees and late payment fees can add up without you realizing. Get ahead of this by managing your monthly payments.

What Does Your Savings Look Like?

What’s better than keeping your money under the mattress? Putting it into a savings account that grows with you. Opening a savings account takes no time at all and can be a valuable resource. Keeping your money secure, assisting with goals and guaranteed growth are a few good reasons to use them. Take advantage of one or more of our savings options and make your money work for you.

Your Financial Refresher

If you’ve ever felt out of the loop during a financial conversation, don’t worry. We’ve all been there. Mastering your finances can be overwhelming sometimes, and it may take time to decide on a starting point. That’s where our learning center comes in.

We’ve pulled together a comprehensive list of educational articles, courses and guides all in one convenient place to help you master your financial conversation points. Outside of conversations, these resources will help you understand banking basics, homeownership, unexpected expenses and so much more. Launch one of our free courses now!

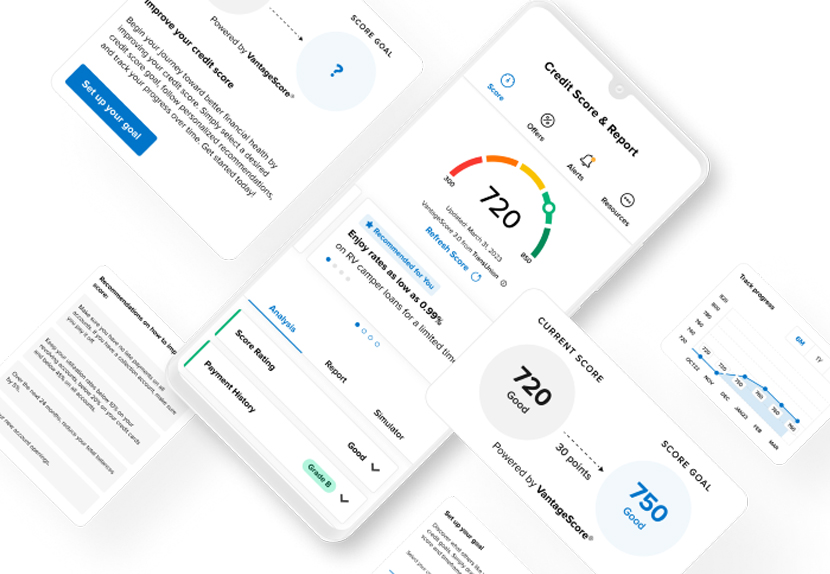

Improve Your Chances with Improved Credit

Do you know your credit score? If you're looking to upgrade your old vehicle to a stylish new car or give yourself an advantage when applying for a home loan, your credit score can play a key role in that process. If your score is not where you hoped, become a Landmark member and use Credit Hub powered by Savvy Money to set you on the right track. Check your score for free, setup alerts, set credit goals and learn how you can enhance your score1.

Want an In-Depth Breakdown of Your Credit Score?

Check out our helpful article on what makes up your score and tips for credit score improvement.

Mastering Your Budget

If learning how to budget is a part of your New Year’s resolution, try one of these popular strategies. Stay in control of your money by using Loud Budgeting to keep your budget in the conversation or learn how to pay yourself first. Find the best starting place below.

-

A reverse style of budgeting where you take your monthly income and set aside cash for your savings goals first. After that, you use the rest for necessary bills and other expenses. Figure out what percentage you want to save each month and automatically take that amount out per paycheck right away. You can always increase or decrease the amount you are taking out depending on your comfortability.

- Great for those who want to save without investing a lot of time and energy into a budget.

- Not the best strategy for those that have very little wiggle room with bills and leftover income.

-

An oldie but a goodie. Set your spending limit for each category you spend money on like groceries or utilities. Then fill an “envelope” with money you will use on that category. While using a physical envelope used to be the preferred method, you can approach this any way you like. This method helps to prevent overspending on unnecessary categories or reach a savings goal.

- This strategy works for those who want a physical grasp on where their money is spent.

- Since this method involves physical money, it can have the pitfall of misplacing funds. Additionally, it requires time and energy to manage several “envelopes”.

-

This strategy involves splitting your income across three categories. Break out your money into 50% for needs like bills or groceries, 30% for wants like a night out with friends and 20% for general savings or paying off debt. Remember, it’s important to stay consistent with your categories. Swapping expenses from bucket to bucket is not ideal and can ultimately defeat the purpose of the budget.

- Perfect for those who need a consistent budgeting strategy but don’t need to worry where every dollar goes.

- Not ideal for those with changing expenses like contract workers.

-

Great for planners, this method uses every dollar and cent deliberately. Allocate your money to all needs, wants, investments and savings. The goal: income minus expenses, equals zero. Layout your take-home income for the month. List all your necessary expenses like your mortgage and car insurance. Then any other expense categories like groceries, transportation and entertainment. Take your income and start subtracting your expenses from it. Whatever is left, move it to savings, retirement accounts or an emergency fund until you reach zero.

- This is a good strategy for budgeting pros who want to know every detail of their dollars spent.

- This won’t work for individuals who prefer an out of sight out of mind method of saving.

Quick Tips Before Buying a Home

-

Align Your Credit

Stability is the name of the game here. Lenders want to know that your income is steady and that you can make payments on time. Learn ways to improve your credit score in our article How To Improve Your Credit Score. -

Calculate What You Can Afford

Before you get pre-approved, use a mortgage calculator to estimate your monthly payment. Double check that it aligns with your budget and works with your annual income. -

Get Pre-Approved

A pre-approval is a free estimate of how much you will be approved for a home loan. Not only will this provide you with a baseline during your search, but it also gives you an edge when putting in an offer. -

Save For a Down Payment

Determine the percentage that you’re comfortable putting down and save! Keep in mind, putting a higher down payment can help lower your monthly mortgage payment.

Prepping to Sell?

Not only are we here to help with your home buying needs, we’re also ready to help you move into your next home. We can’t pack up the pots and pans, but we can start you in the right direction! If you’re thinking about selling, there are steps you can take to know what you can and cannot afford. Additionally, there are ways you can prepare your home to appeal to potential buyers. Here are some great steps to take if you are preparing to sell your home.

-

Upgrading your home can also mean upgrading your mortgage costs. Even if you’re downsizing, the cost can be more. As an example, you could be going from a $200,000 home to a $300,000 condo. Before making the move, remember to review your finances and make sure you’re comfortable with a new monthly mortgage cost.

-

Chat with a real estate agent before starting a home improvement project. You may think a particular project will add a lot of value, but it may not be what people in the market are looking for. Sometimes simple aesthetic updates are the most worthwhile investments when you're preparing to sell your home. Your real estate agent can help you determine what looks most appealing to a buyer, to get you the best bang for your buck.

-

Declutter your home before you put it on the market. Make it as simple as possible so buyers can imagine themselves in the home. Removing clutter can also make rooms appear larger and more appealing.

-

The best first step in this process is to talk with an experienced loan officer. Set up a meeting so they can walk you through the process and create a comfortable timeline. Establish what you need to do with your home beforehand, and what actions you can take to feel financially stable going forward.

A loan officer will break down where you are financially and make recommendations on what you can afford and what you should avoid purchasing. For example, if you’re planning on buying a new car while you plan to move, they may recommend pushing off the purchase of a new vehicle until you close on your new home loan. Our loan officers can help you get a holistic look at the entire process before taking the next steps.

Time For a Change of Scenery?

The homebuying process comes in all shapes and sizes. Whether you’re going from renting to owning, downsizing your living situation or building a dream home, our experts can help. If it’s time to make a move, we have the resources to get you there. Attend a seminar in person or online to get a new perspective on homebuying.

Get more tips for buying a home in our recent article Essential Guide for First-Time Homebuyers.