Top 3 Certificate Saving Strategies – How They Work

Posted: August 15, 2024

Updated: August 15, 2024

Working towards a long-term savings goal or simply trying to maximize your savings potential? Ramp up to something bigger with unique savings strategies!

There are plenty of strategies at your disposal that can get you more than your average savings account. Use your funds to open multiple certificate accounts and watch your money multiply with larger returns over set periods of time or one large sum in the end. First, let’s go over the basics.

What is a Certificate?

A certificate is a deposit account that enables guaranteed growth for your money at a fixed rate over a set amount of time. These accounts are a great choice for someone who doesn’t need to make consistent withdrawals from their account and is saving for a future goal.

To put it simply, a certificate is like a high yield savings account that locks in your money and grows while you wait. Once you pick a term for your certificate you can deposit either the minimum amount of funds12 needed to open the account or as much as you feel comfortable depositing. Over the life of the term, your funds will grow according to the percentage rate at the time of opening. At that point your rate is fixed, and there is no need to monitor any rate changes. Think of it as an autopilot feature for your savings.

Once you have reached the end of your term, you can withdraw the funds that you have accumulated or reinvest it into another certificate with the same or different term. If you want a deep dive on everything you need to know about certificates, take a couple minutes to explore our online education courses and become an expert!

Benefits of Certificates

High dividend rates: Dividend rates for your certificate will vary depending on what type and term you choose. However, on average a certificate can have a dividend rate much higher than your traditional savings account. Additionally, there's no need to keep a constant eye on shifting rates since your rate will be locked in after opening the account.

Guaranteed return: Certificates don't come with the risks associated with investing in the stock market or other volatile options. With a certificate your money is kept safe and in a growing environment.

Federally insured: When an account is federally insured by the National Credit Union Association (NCUA), the funds are protected up to $250,000 per account owner. For instance, if you have multiple accounts open and the total sum of those accounts equal to $300,000, you will be insured for only up to $250,000 under most circumstances. All Landmark accounts, including certificates, are insured by the NCUA.

How can I maximize my return?

At this point you may be thinking, is there a way I can increase my cash flow while I wait for one certificate term to end? If you are, we applaud you for thinking ahead! While opening one certificate is already a great way to save for the future, allocating your funds with multiple certificates and using strategies like barbells, ladders and target is even better.

Keep in mind these three strategies require focus and should only be started when you’re ready. Make sure you review your finances beforehand so you can confidently use a certificate strategy for the future.

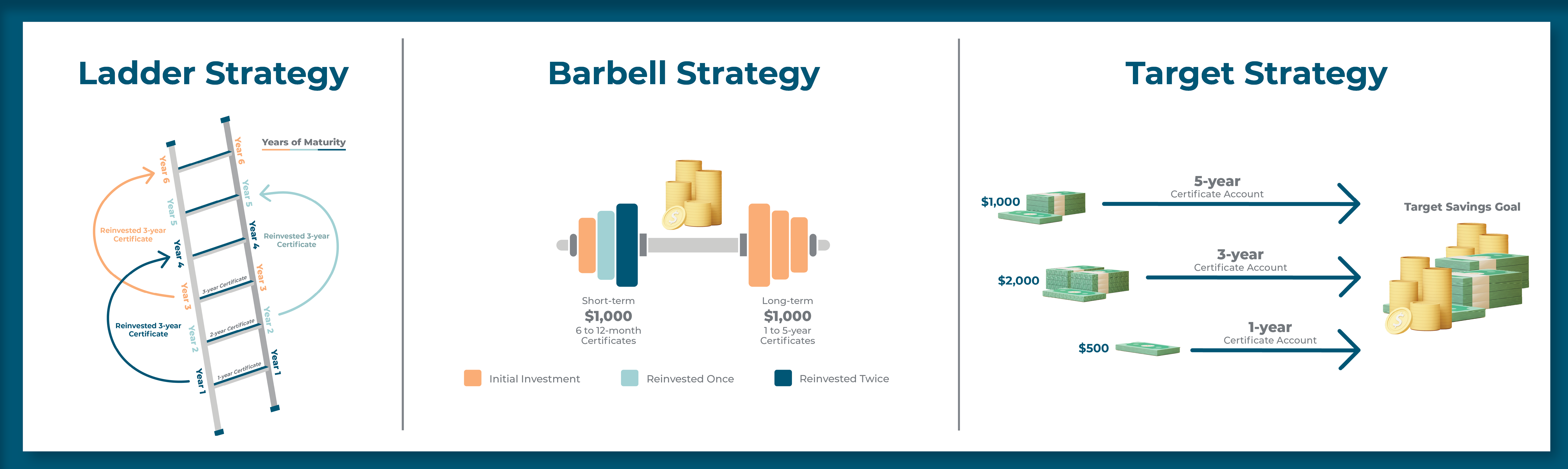

Extend Your Strategy: Certificate Ladders

One of the most common strategies for saving with certificates is the certificate ladder. This method involves starting a series of accounts, all of which are different term lengths. Simply, divide your investments, commonly in equal amounts, with multiple terms creating “rungs” of certificates. As a shorter term matures, you take those earnings and reinvest into a longer term certificate, which creates another rung on the top of your ladder.

Let’s go over a quick example of how this strategy works. Let’s say you have $1,800 to invest. To start your ladder, split your investment into equal parts and open three separate certificates.

-

$600 in a one-year certificate

-

$600 in a two-year certificate

-

$600 in a three-year certificate

Your certificate ladder has been created, and it’s time to start climbing! When the one-year certificate reaches its maturity, you can take the $600 you invested plus the dividends earned over time and reinvest it into a five-year certificate.

Ideally, as each year passes one of your rungs will reach its maturity and you can reinvest it into another five-year certificate. Doing this year over year keeps adding steps to your ladder and increases your earnings over time. You can keep this strategy going for as long as you are comfortable doing so.

Using the ladder strategy helps you look at the big picture when it comes to investing. As you take advantage of short, midrange and long-term certificates, you create a diverse savings pattern. Keep in mind that your ladder can be any number of time frames rather than one-to-five-year terms. You could create a smaller ladder using 6 months, 9 months and 12 months. As long as you apply the concept of reinvesting, or adding another rung, you’re using the strategy correctly. Remember, this strategy works best when you don’t withdraw your funds. If you need faster access to your funds, it may be better to look into other strategies, account types or create an emergency fund beforehand. You could look into a money market account to still see growth over time while maintaining the flexibility to withdraw your funds when needed.

Combo Flexibility and Profit: Certificate Barbells

The name for this strategy comes from the way your funds are allocated to either spectrum of term periods, like the weights of a barbell. Using the barbell strategy involves splitting the funds you want to invest down the middle and opening short-term as well as long-term certificates. A barbell strategy is largely used against volatile market rates. As your shorter-term certificates mature (3-6 month certificates), you can evaluate the current rates and continue investing in short term or long term certificates.

As an example, let’s take a $1,000 investment:

-

Open a short 3-month certificate with $500

-

Open a long 5-year certificate with the other $500

-

As the short terms mature, you can choose to reinvest it in either side of the barbell depending on rates or financial needs

Why should you use the barbell strategy? The key is to balance long-term growth and short-term liquidity. This strategy gives you the best of both worlds. Not only do you have a long-term investment that grows while you wait, but you’ll also have smaller investments that offer a lot of flexibility. In both cases you’re multiplying your cash flow, but one end of the barbell allows you to withdraw funds consistently. Additionally, if you’re waiting for rates to rise, a barbell allows the flexibility for you to invest when a better rate comes around.

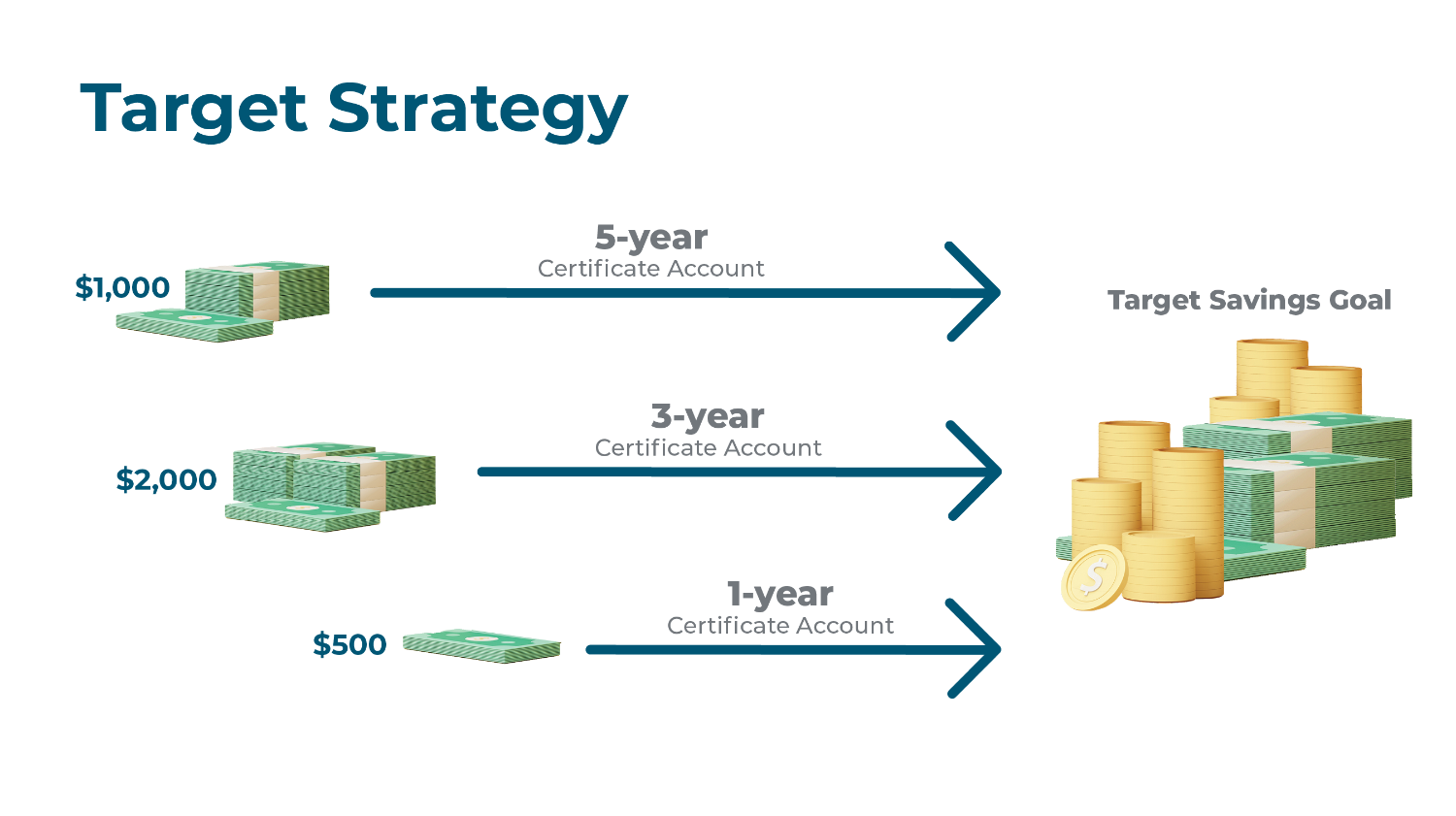

Hit Your Future Goal: Certificate Targets

The last certificate strategy is the target strategy. This is often used for very specific financial goals like saving for a down payment, upcoming wedding expenses or a larger than normal vacation. With the target strategy, you’ll open several certificates that all mature at roughly the same time and have a large, accrued sum of money for whatever target goal you’re saving for.

Let’s think about saving for a down payment on your first home. You know that you aren’t ready yet, but you would like to move in roughly five years.

-

You have $1,000 saved and decide to open a five-year certificate

-

After two years you have $2,000 of spendable income and open a three-year certificate

-

One year before deciding to move, you invest another $500 into a one-year certificate

Over the course of five years, you’ve had three separate certificate accounts growing funds. When the final year is up and all three accounts have reached their maturity, you can use the total sum of the accounts to pay for your down payment!

Setting chunks of money aside is a very common savings tactic, but using certificates to lock portions of money away so it can grow at a faster rate is the upgraded version of that tactic. Not only does it prevent you from accessing the money you invested, but it also allows you to earn higher dividends over time.

Remember, this strategy is not meant for reinvesting or diversifying your accounts. It’s about focusing on a future purchase, down payment or savings goal.

Choose Your Strategy

If you need to maximize your savings over time or want to reach a specific savings goal, pair your certificate account with unique strategies. Take advantage of the ladder, barbell and target strategies to increase your overall earnings. Want to get started? Open a certificate today or schedule an appointment with an expert to talk about what strategy works best for you.