The Fulfillment of Volunteerism

Posted: November 24, 2025

As one chapter closes and another life chapter opens, many retirees choose to transition into volunteering, filling their time with causes close to their hearts.

We look at how finding joy in volunteering can align with your financial plan in this exploration of the transition from work to volunteer.

A Meaningful Way to Give Back

A planful retirement is about embracing your new-found freedom with volunteerism and other activities that are especially meaningful to you.

While working, you may not have had as many opportunities to volunteer as you would have liked. However, now with more time available, volunteering can be an extremely fulfilling and meaningful way to give back. Being a volunteer offers several benefits, including:

- Connect with others. Volunteering is a social activity and introduces you to people who may share similar experiences and passions, fostering new friendships.

- Experience personal growth. Volunteering gives you a sense of purpose, develops new skills and insights, and boosts your self-confidence.

- Enhance your mental health. Stepping outside of yourself can take your mind off your worries, reduce stress and improve your self-esteem.

- Offer community support. Helping others benefits everyone and through offering community support, it enhances your community’s well-being.

Check with your state or local organizations for volunteer opportunities. In addition, more informal ways to volunteer can include helping an elderly neighbor with outside chores, stepping in to help someone with emergency childcare or pet care, and running errands or taking someone to an appointment if they’re unable to drive.

As a volunteer, certain out-of-pocket expenses from your volunteer work for a qualified charitable organization may be tax-deductible.

How to Develop a Sound Financial Plan

Financial planning builds confidence that you are exactly where you should be. As a retiree, planning is important for safeguarding your financial future and allowing you to take advantage of opportunities, such as volunteering.

A sound financial plan aims to:

- Create a stable income with less reliance on Social Security

- Reduce financial stress

- Ensure you can maintain your desired lifestyle

- Cover future healthcare expenses

- Leave a legacy for a loved one or causes you care about

In planning for retirement, it’s important to consider your retirement income sources. They might include Social Security, pensions, part-time work and other investments that you may have.

Some people may experience a retirement savings gap, which is the difference between how much is saved for retirement and the amount needed to cover expected expenses once retired.

If you're mid-career and feel like your savings isn’t quite where it should be, you are likely experiencing a savings gap.

These are some circumstances that can lead to retirement savings gaps:

- Late Start: Beginning retirement savings in your 30s or 40s instead of your 20s, missing out on decades of compound growth that could have doubled or tripled your nest egg.

- Career Breaks: Taking time off to raise children, caring for aging parents or pursuing education, which interrupts both earning potential and consistent contribution habits.

- Underestimating Needs: Assuming you will need only 60-70% of your current income in retirement, when healthcare costs, inflation and longer lifespans often require 80-90% or more.

- Inconsistent Contributions: Starting and stopping retirement contributions based on financial pressures, or failing to increase contributions as income grows, leaving money on the table year after year.

- Early Withdrawals: Unexpected financial hardships, such as medical crises, home repairs or job loss, cause some people to withdraw from their retirement accounts before age 59½.

We can review your current financial situation to determine what steps need to be taken to address your retirement goals.

Additional Financial Guidance

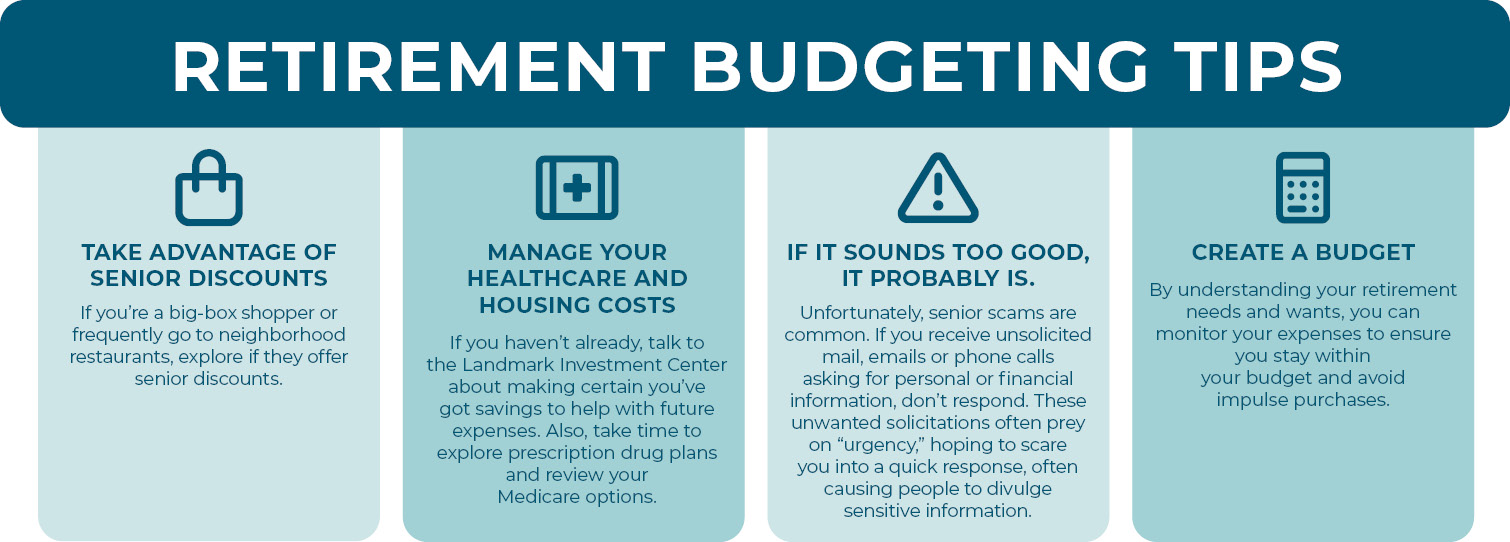

These budgeting tips can help you stretch your dollars when you retire:

- Take advantage of senior discounts. If you’re a big-box shopper or frequently go to neighborhood restaurants, explore if they offer senior discounts.

- Manage your healthcare and housing costs. If you haven’t already, talk to the Landmark Investment Center about making certain you’ve got savings to help with future expenses. Also, take time to explore prescription drug plans and review your Medicare options.

- If it sounds too good, it probably is. Unfortunately, senior scams are common. If you receive unsolicited mail, emails or phone calls asking for personal or financial information, don’t respond. These unwanted solicitations often prey on “urgency,” hoping to scare you into a quick response, often causing people to divulge sensitive information.

- Create a budget. By understanding your retirement needs and wants, you can monitor your expenses to ensure you stay within your budget and avoid impulse purchases.

Retirement is about taking a planful approach to your personal and financial success. Many people choose to jump into retirement, but others “gradually” retire. This might involve reducing work hours and being rehired as a contractor or consultant.

To ensure your retirement is thoughtfully planned and that you will have enough income to enjoy this next chapter, let’s talk! A Landmark Investment Center financial consultant can help you design a plan that gives you the financial freedom to volunteer or explore other rewarding pastimes.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. No strategy assures success or protects against loss. This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.