Banking Made Easy

It’s about time banking was less about obstacles – and more about you. It’s about time banking was faster. More convenient. Clearer. Less friction and more friendly. With banking options on your terms. All from a strong, stable credit union with great rates and low fees. At Landmark Credit Union, we are all about less complicated banking. We make navigating the everyday and achieving your dreams easier than you ever imagined. Whether you’re banking online or in person, Landmark’s powerful tools, streamlined processes and thoughtful guidance make all the difference. After all, who you bank with is just as important as where you bank. Look for the Landmark. And get one step closer toward a life less complicated.

-

35 Branches

-

Over $6 Billion in Assets

-

Over 390,000 Members

-

Over 1,000 Associates

Our Vision

Everyone in our communities is financially empowered to fulfill their dreams.

Our Mission

Build and nurture lasting relationships that empower our members and strengthen our communities. We do this through financial education and information, meaningful and relevant offerings, and exceptional and caring service.

Become a Member

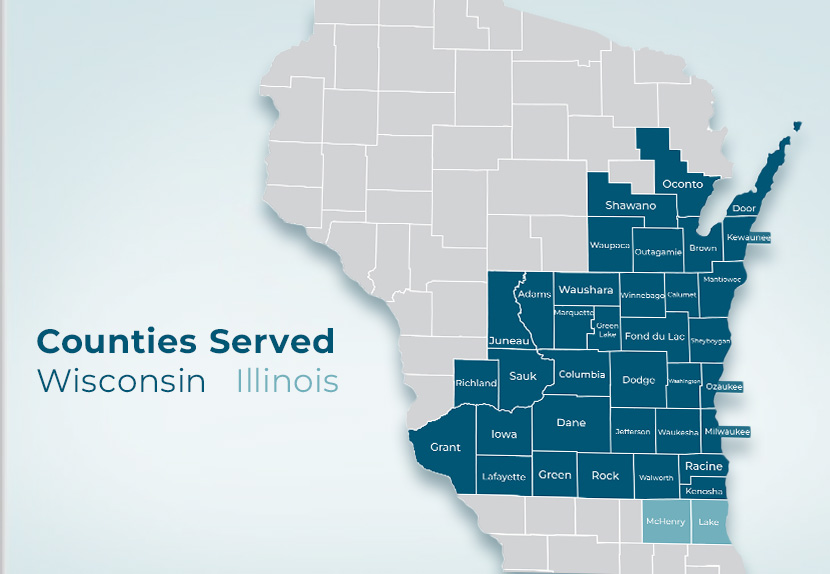

We serve all people who live or work in Southern and Northeastern Wisconsin, plus Lake and McHenry Counties in Illinois, as well as immediate family members of all individuals eligible for membership. Immediate family is defined as spouse, parent, child, stepchild, sibling, stepsibling, grandparent or grandchild. This also includes stepparents and stepchildren. Additionally, we serve businesses with a location in Southern and Northeastern Wisconsin, plus Lake and McHenry Counties in Illinois.

Joining is easy! Just open a VIP Savings Account with a minimum of $5.

We’re committed to providing a safe and welcoming environment for all. Please read our Member Code of Conduct.

Southern and Northeastern Wisconsin as well as Northeastern Illinois* include the following counties: | ||

Brown County | Calumet County | Columbia County |

Dane County | Dodge County | Fond Du Lac County |

Green County | Green Lake County | Iowa County |

Jefferson County | Kenosha County | Lake County* |

Marquette County | Manitowoc County | McHenry County* |

Milwaukee County | Outagamie County | Ozaukee County |

Racine County | Rock County | Sheboygan County |

Walworth County | Washington County | Waukesha County |

Winnebago County | Adams County | Door County |

Grant County | Juneau County | Kewaunee County |

Lafayette County | Oconto County | Richland County |

Sauk County | Shawano County | Waupaca County |

Waushara County | ||

Landmark Leadership

-

![Jay Magulski]()

Jay Magulski

President and Chief Executive Officer

-

![Dave Powers]()

Dave Powers

Chief Financial Officer

-

![Brian Melter]()

Brian Melter

Chief Experience Officer

-

![Jodi Greenmeier]()

Jodi Greenmeier

Chief People Officer

-

![Mark Kennedy]()

Mark Kennedy

Chief Lending Officer

-

![Steve Hannan]()

Steve Hannan

Chief Information and Risk Officer

Board of Directors

-

Brian Dorow

Chairperson

-

Grace Kostroski

Vice Chairperson

-

Nancy Dickman

Secretary

-

Jay Magulski

Treasurer

-

Mike Erwin

Director

-

Ailec Gonzalez

Director

-

Nelson Phillips III

Director

-

John Schulze

Director

-

Jennifer Bognar

Director

-

Dane Sandersen

Associate Director

Our History

In February 1933, a group of employees at Rex Chainbelt Company (later Rexnord Corporation) pooled their funds to form Rex #2 Credit Union. The goal of this new not-for-profit financial cooperative was to provide affordable financial services to Rex Chainbelt Company employees.

The organization was run by volunteers until Joseph Woelfel was hired as the first full-time paid manager. Over the years, the credit union changed names (Chabelco Credit Union, Rexnord Credit Union) but continued to offer financial guidance along with competitive products and services.

By the time of Joseph Woelfel’s retirement, our assets had grown to $2 million, with about 2,000 members. In 1973, Ron Kase was elected by our board of directors to succeed Joseph as president. He served as president for 39 years of steady growth.

In 1985, we changed our name to Landmark Credit Union to better reflect our ability to serve Milwaukee and Waukesha counties at large.

After 39 years of working with Landmark, Ron Kase retired, and a new CEO was chosen. Jay Magulski was appointed as CEO in 2013, and his vision continues where Ron’s left off – to continue to provide the highest level of member service to all.

-

![Historic image of Rex #2 associates in 1933. A group of employees at Chainbelt Company (later Rexnord) form their own credit cooperative, named Rex #1. Shortly after Rex #2 was formed.]()

1933

Rex #2 Credit Union established for Rexnord employees -

1944

Joseph Woelfel hired as the first full-time employee at the credit union -

![Historical image of a credit union member using an ATM outside the first brick and mortar location that opened in Milwaukee in 1970.]()

1970

Credit union moves to a building outside of Rexnord -

![Historical image of Ron Kase at a credit union branch]()

1973

Board elects Ron Kase as the new president -

1983

Membership eligibility expands to Milwaukee County residents -

![A close-up of a newspaper headline from 1985 that reads "Rex #2 Changes Name to Landmark Credit Union." The headline is in large, bold letters, and the text below the headline says, "New name reflects]()

1985

Name changed to Landmark Credit Union -

1986

Lake Country Credit Union Merger -

1998

CityFirst Credit Union Merger -

![A stack of money in a pile, representing Landmark's $1 billion asset milestone.]()

2005

Landmark becomes the first credit union in Wisconsin to reach $1 billion in assets -

2007

Belle City Credit Union Merger -

2009

Allco, First Security, LifeTime and Wiscor Credit Union Mergers -

2011

Horizon Credit Union Merger -

2012

Landmark reaches $2 billion asset milestone -

![Jay Magulski at a Landmark Credit Union branch in 2013.]()

2013

Jay Magulski appointed as Landmark's new CEO -

2013

Badger Campus Credit Union Merger -

2014

Hartford Savings Bank Merger -

2016

Landmark reaches $3 billion asset milestone -

2019

First credit union in Wisconsin to reach $4 billion in assets -

2020

Landmark reaches $5 billion asset milestone -

![A group of Landmark executives in white helmets on groundbreaking day for the new corporate headquarters in Brookfield, WI.]()

2021

New corporate headquarters in Brookfield, WI -

2022

Landmark reaches $6 billion asset milestone -

2022

Launch of TYME® Advanced ATMs -

![Landmark Credit Union logo with updated branding in 2023. The new logo features a lighthouse with the copy "Landmark Credit Union" in white. Rays of light flank the lighthouse.]()

2023

Landmark gets a new look

Serving Our Communities

Our philosophy of “people helping people” stretches beyond our membership and into the communities we serve. We are committed to and support community, civic, educational, cultural and human service organizations.